Get $10 in rewards with as little as $133 spent. … Read more

Best Credit Cards RIGHT NOW – April 2024

What are the best credit cards for cashback, travel, etc.? … Read more

Mortgage Rates Today (Week of April 15-21)

The average 30-year fixed mortgage rate is approximately 7.23% APR … Read more

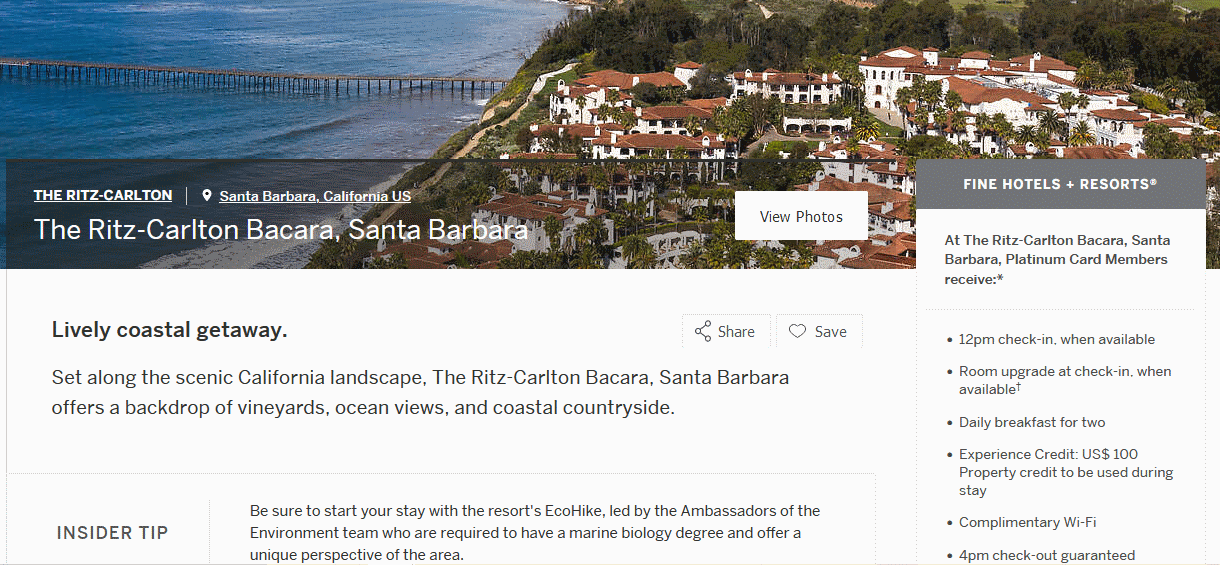

List of All American Express Fine Hotels + Resorts (and The Hotel Collection)

The American Express travel programs, “Fine Hotels + Resorts” and … Read more

Petal Card Sold to Empower Finance – Sad Ending or New Beginning?

Once-promising credit card targeting an underserved audience was slowly dying. … Read more

Best High Yield Savings Accounts – April 2024

You can earn over 4% on savings from many banks. … Read more

Best CD Rates – April 2024

Rates are still pretty high, if you’re willing to commit. … Read more

SoFi Credit Card Becomes 2.2% Cash Back IF Checking/Savings and Direct Deposit

It’s pretty much the best “flat” cash-back reward out there. … Read more

Best Travel Credit Cards – April 2024

What’s the right credit card “strategy” for earning free travel? … Read more

Best Buy Credit Card Review 2024

Good rewards or financing IF you use the card right. … Read more