1. AAA Daily Advantage Visa – 5% cash back on […]

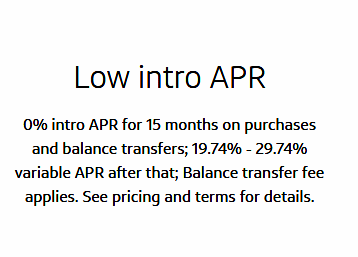

Best 0% APR Credit Cards (on New Purchases)

You’ll pay no interest for as long as 15 months. […]

Instant Approval Credit Cards – Apply, Get Approved, Use Today

A long list of credit cards you can use immediately. […]

Best Balance Transfer Credit Cards

Transfer balances and pay no interest for a looooong time! […]

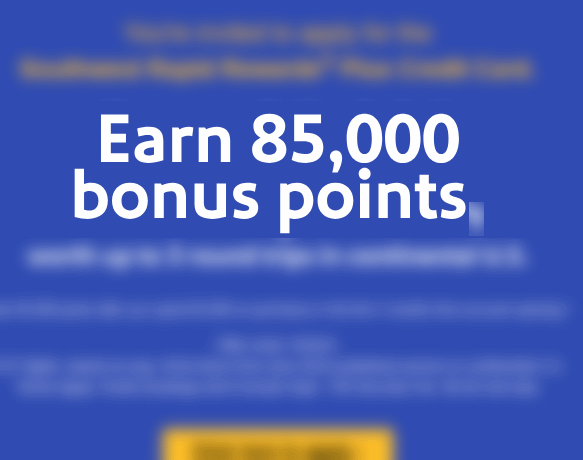

Best Credit Card Bonus Offers

Credit card issuers are often VERY generous with bonus offers […]

Best Bank Account Bonus Offers – Checking / Savings Promotions

The best bank account bonus offers right now. Be sure […]

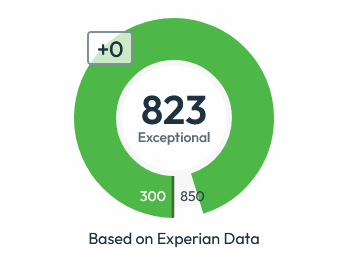

How to Check Your Credit Score for Free, Without a Credit Card

These sources will provide you a credit score without payment. […]

What is a good credit score? (What credit score ranges REALLY mean)

Straight talk on how lenders think about your credit score. […]

American Express “Refreshes” Gold Card, with New Credits and Increased Annual Fee

Changes also include a limited-edition white gold Amex credit card. […]